WHO WE ARE

We are Dodwell & Co., brokers of financially settled coal derivatives. Our CEO is Ian Carter, a procurement professional and investor.

OUR HISTORY

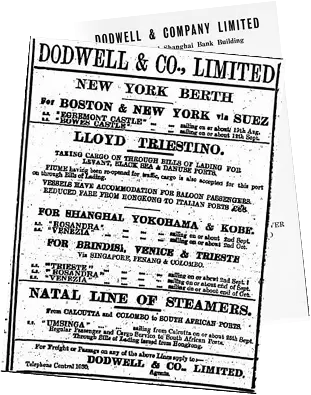

Dodwell & Co. (天祥洋行) was one of the great British trading “Hongs” of the 19th and 20th centuries, active across China, Japan, and Southeast Asia.

WHAT WE DO

Dodwell & Co. brokers coal swaps – both collared and uncollared – focused on Asia Pacific markets and indexed to Indonesian coal benchmarks.

For newcomers, we recommend reading the relevant chapters to understand the mechanics of coal derivatives.

WHEN WE LAUNCHED

On 14 April 2025,

Dodwell & Co. secured a derivatives trading licence for the use of SCR indices — currently the only broker licensed to use Sceats-Coal.Report benchmarks in financial contracts.

WHY

INDONESIA?

Indonesian coal is the price-setting power station feedstock fuel which powers the fastest growing economic region in the world, and yet the Asia Pacific coal market has long lacked a transparent and trustworthy forward curve — largely due to weak Indonesian benchmarking and conflicts of interest as regards the ownership of certain Australian coal indices.

OUR FEE STRUCTURE

We charge a simple consultancy fee of US$0.05/tonne, covering deal introduction and confirmation

Market Makers Trade Free

If you provide two-way markets (i.e. meaningful bid/offer spreads), you pay zero commission.

WHAT ELSE?

All deals are formally confirmed in writing using our standard confirmation template.

FREQUENTLY ASKED QUESTIONS

Q1. Do you broker API#2, API#4 or GlobalCoal Newcastle swaps?

A: No. We are focused exclusively on the Asia Pacific market, and specifically on Indonesian coal — which powers the world’s fastest-growing economies and now has reliable benchmarks.

Do we need an ISDA Master Agreement to trade Indonesian swaps?

A: No. ISDA use is optional. Where needed, ISDA Long Form confirmations are used on a deal-by-deal basis. We provide a standard Long Form template free of charge. Collared swap transactions only require the broker confirmation (unless the counterparties specifically choose otherwise).

Can we use another broker to trade Indonesian swaps based on SCR?

While this may change at some point in the future, at present, only Dodwell & Co. is licensed to use SCR benchmarks in derivatives.

📜 Quote SCR: “Use in derivative trading requires a licensing agreement with SCR. Unauthorized use incurs a 10% fee based on the contract value.”

You’re a new name — how do we know this is safe?

A: Dodwell & Co. is a new venture rooted in the long-standing legacy of the original Dodwell merchant house. We are a consultant, not a counterparty — meaning we don’t hold funds or take title. We simply introduce buyer and seller, provide documentation, and charge a small consultancy fee if a deal is done.

Are you hiring?

A: Yes. We’re expanding in Asia Pacific.

Send your CV to: Ian@Dodwell-Broker.net